Investing early in life can be one of the most impactful financial decisions you ever make. While it might seem daunting or unnecessary when you’re young, starting early offers numerous benefits that can set you up for long-term financial success. In this blog, we’ll explore the lifelong benefits of making early investments and why it’s crucial to start as soon as possible.

1. The Power of Compounding

One of the most significant advantages of early investment is the power of compounding. Compounding occurs when your investment earnings generate their own earnings. In other words, the interest you earn starts earning interest itself. The earlier you start investing, the more time your money has to grow exponentially.

For instance, if you invest $1,000 at an annual return of 7%, it will grow to about $7,600 in 30 years. However, if you wait 10 years to invest the same amount, it will only grow to about $3,870 in 20 years. Starting early gives your money more time to compound, resulting in significantly higher returns over the long term.

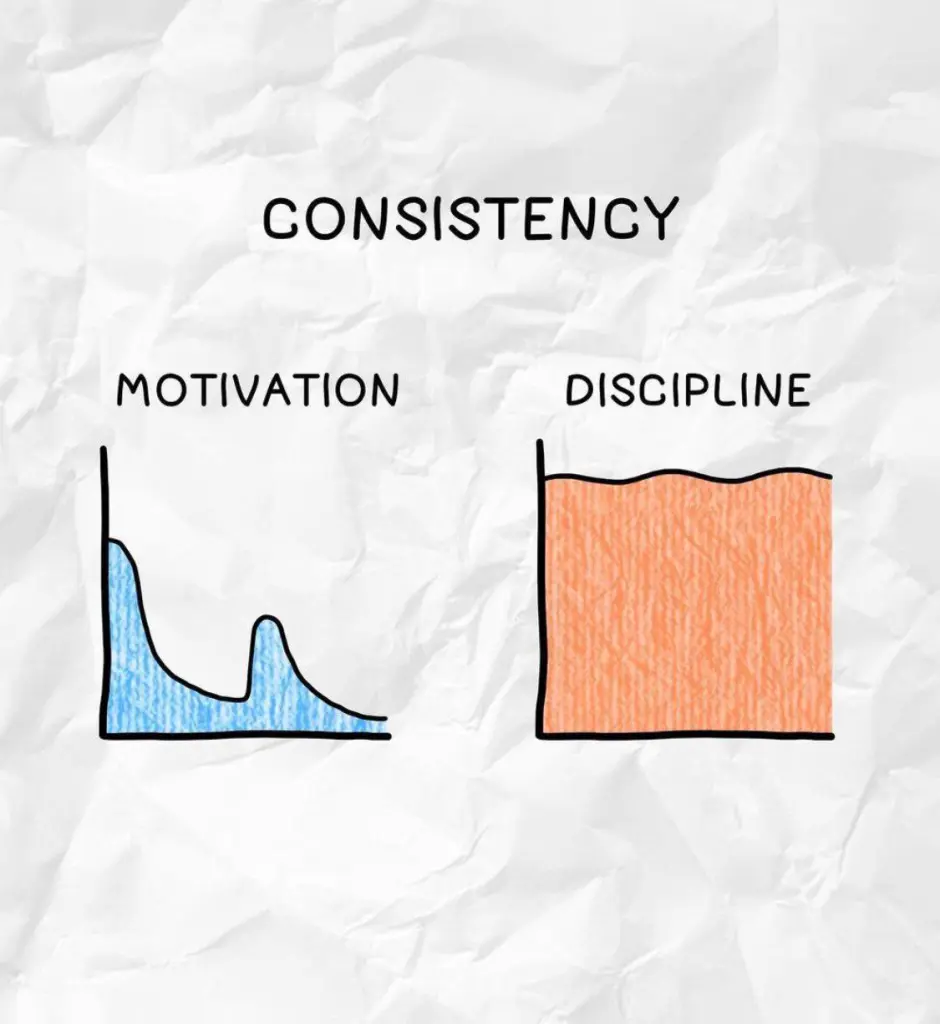

2. Building Financial Discipline

Starting to invest early helps develop good financial habits and discipline. It encourages regular saving and investing, which are essential for financial stability and growth. By consistently setting aside money for investments, you learn to prioritize your financial future and make informed financial decisions. This discipline can spill over into other areas of your life, helping you manage your finances better overall.

3. Achieving Financial Goals

Whether it’s buying a house, funding your children’s education, or planning for retirement, early investments can help you achieve your financial goals more easily. When you invest early, you have more time to accumulate wealth and can take advantage of compound growth. This means you can reach your goals with less financial strain and without having to make large contributions later in life.

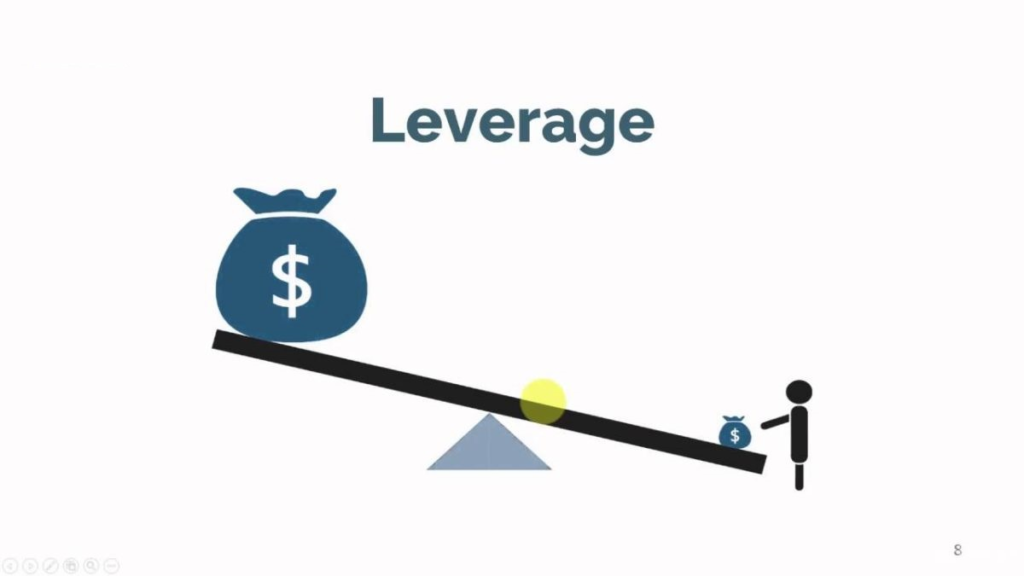

4.Leveraging Risk Tolerance

When you’re young, you have a higher risk tolerance because you have more time to recover from potential losses. This means you can invest in higher-risk, higher-reward assets like stocks. Over time, these investments can yield significant returns. As you get older and your risk tolerance decreases, you can gradually shift your portfolio to more conservative investments. Starting early allows you to take advantage of the higher growth potential of riskier investments while you’re still in a position to absorb potential losses.

5. Generating Passive Income

Investments can generate passive income through dividends, interest, and capital gains. This additional income stream can supplement your regular earnings and help you achieve financial independence. Over time, as your investments grow, the passive income generated can become a significant part of your overall income, allowing you to work less or retire comfortably.

Conclusion

The lifelong benefits of making early investments are clear. From the power of compounding and financial discipline to achieving your goals and reducing stress, starting early sets the foundation for a secure financial future. By taking advantage of market opportunities, leveraging risk tolerance, and learning along the way, you can build a robust investment portfolio that generates passive income and provides long-term security.

Don’t wait to start investing. The earlier you begin, the more time your money has to grow, and the greater the benefits you’ll reap. Make the decision today to invest in your future and enjoy the lifelong rewards that come with it.