In today’s fast-paced world, managing money wisely is more important than ever. While many people focus on saving, fewer think about the significant benefits of investing. Saving is good, but if you’re not investing, you could be missing out on opportunities to grow your wealth and secure your future. This blog will uncover the hidden costs of not investing and explain why taking action now is crucial.

1.The Erosion of Savings by Inflation

One of the biggest hidden costs of not investing is the impact of inflation. Inflation is the gradual increase in prices over time, which means the value of money decreases. For example, what $100 could buy you a decade ago is much less than what it can buy today. If your money is just sitting in a savings account, it’s likely not earning enough interest to keep up with inflation. Over time, this means your savings lose purchasing power, making your future financial goals harder to achieve.

2.Missed Opportunities for Growth

When you don’t invest, you miss out on the potential for your money to grow. Investments like stocks, bonds, and mutual funds have historically offered higher returns compared to regular savings accounts. While there is some risk involved, over the long term, investments have the potential to significantly increase your wealth. By not investing, you’re essentially leaving money on the table that could have been working for you.

3.Higher Taxes

Certain investments come with tax advantages. For instance, contributions to retirement accounts like 401(k)s and IRAs can be tax-deductible, and the money grows tax-deferred until you withdraw it. Some investments also offer lower tax rates on capital gains compared to regular income. By not investing, you might end up paying more in taxes, reducing your overall wealth.

4.The Importance of Diversification

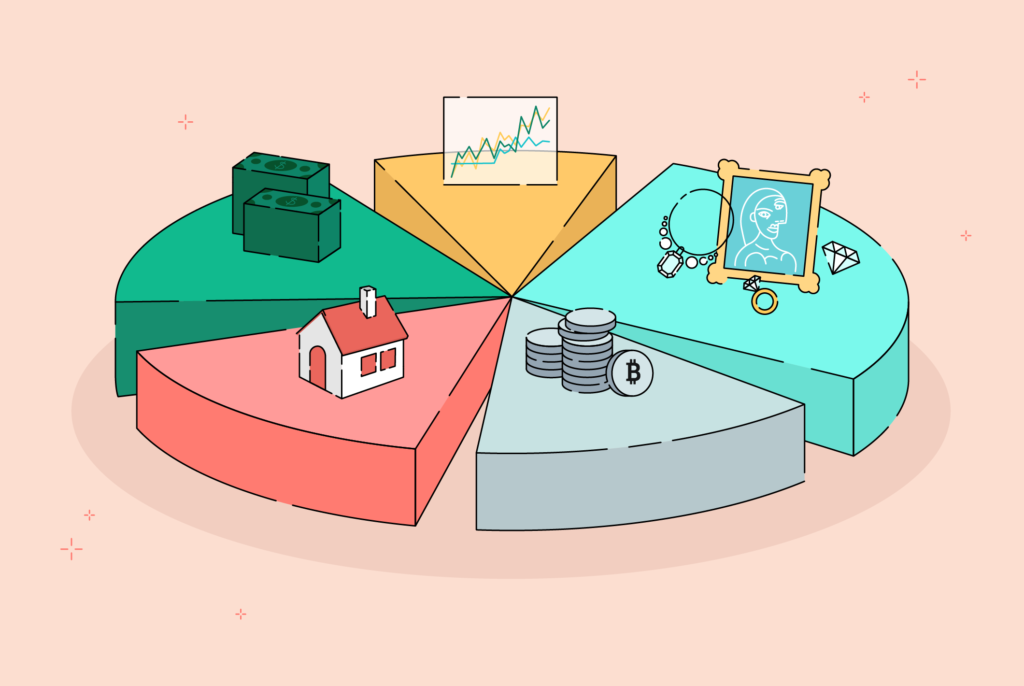

Investing allows you to diversify your financial portfolio, spreading your money across different assets to reduce risk. A diversified portfolio can better withstand market fluctuations and economic downturns. By not investing, you’re putting all your eggs in one basket, which can be risky. Diversification helps protect your wealth and ensures you have a mix of assets that can perform well under various condition.

5.Taking the First Step

Investing might seem intimidating, especially if you’re new to it. However, it’s important to start somewhere. Begin by educating yourself about different investment options and how they work. Consider speaking with a financial advisor who can help you create a personalized investment plan based on your goals and risk tolerance. Starting small and gradually increasing your investments can make the process more manageable.

Conclusion

The hidden costs of not investing are significant and can have long-lasting effects on your financial health. From the erosion of your savings by inflation to missed opportunities for growth and the lack of financial security in retirement, the consequences are clear. By understanding these hidden costs and taking action to start investing, you can build a more secure and prosperous future for yourself and your loved ones. Don’t wait—take the first step toward investing today and unlock the potential for greater financial success.